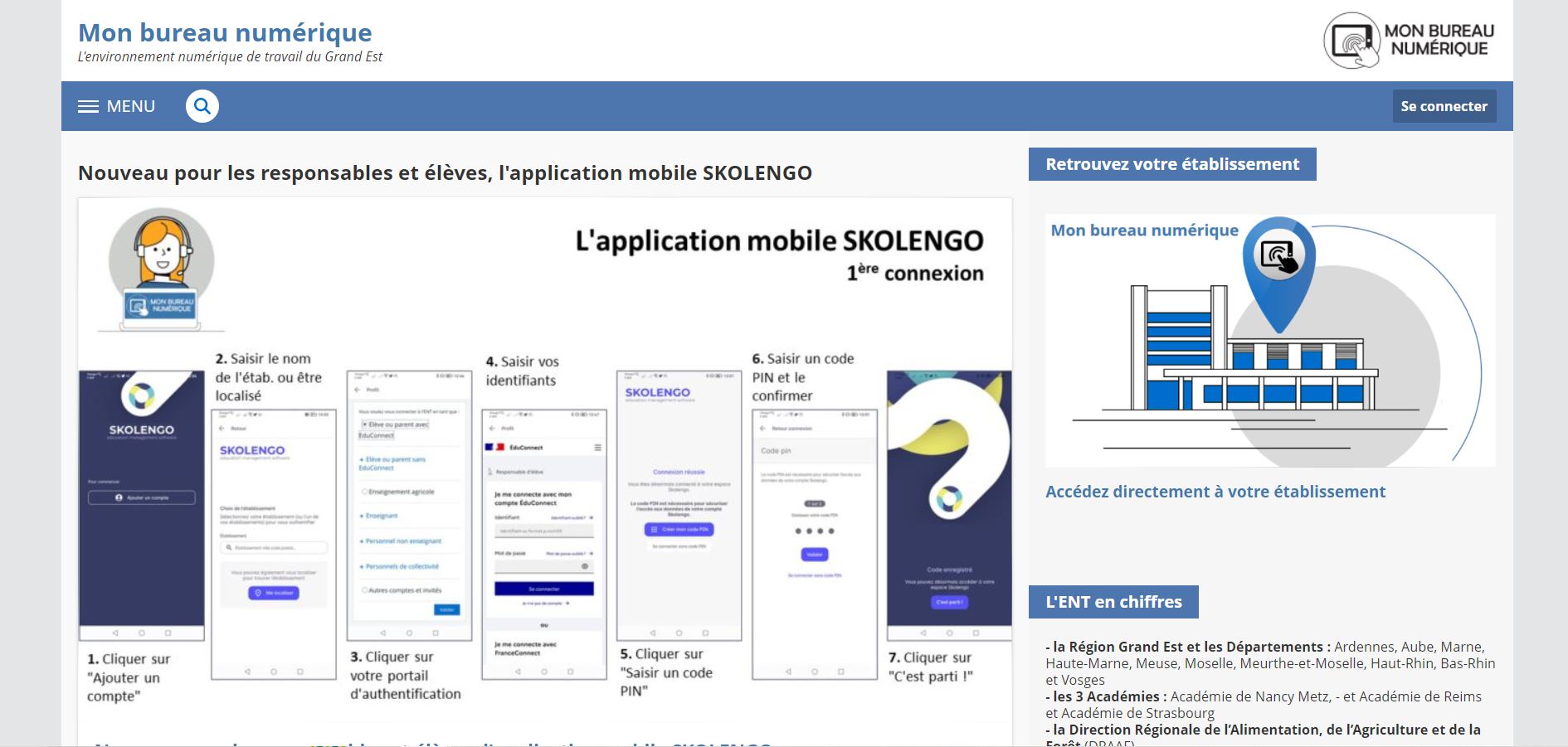

L’apprentissage en ligne pour un avenir durable : l’éducation en ligne respectueuse de l’environnement

Dans le monde en constante évolution d'aujourd'hui, l'importance des pratiques durables ne peut être surestimée. Alors que la société est aux prises avec les défis environnementaux de notre époque, il est essentiel de considérer la durabilité dans tous les aspects de la vie, y compris l'éducation. L'apprentissage en ligne, le...

Read More